- Fee-free USD deposits offered for faster crypto conversions.

- Binance partners with PayPay in Japan for direct crypto purchases.

- Plume Network integration enables gas-free tokenised asset payments.

Binance has unveiled a new feature enabling direct USD deposits and withdrawals through its regulated subsidiary, BPay Global.

Licensed by the Central Bank of Bahrain, BPay Global strengthens Binance’s position in bridging traditional finance with digital assets.

Announced on October 22, the feature is now available to users in over 70 countries.

It offers fee-free SWIFT transfers and integration with Apple Pay, Google Pay, and debit or credit cards, creating a smoother experience for both retail and corporate users seeking secure fiat-to-crypto transactions.

Seamless integration of USD and crypto payments

The new service allows Binance users to deposit and withdraw USD directly through BPay Global, bypassing traditional intermediaries.

Users can store funds in a regulated e-wallet and utilise them instantly for trading or conversions on the Binance platform.

By eliminating deposit fees for SWIFT transfers, Binance aims to reduce the cost and friction of moving between fiat and crypto markets.

This initiative caters to the growing global demand for accessible, compliant, and cost-efficient payment channels.

The move aligns with Binance’s broader strategy to expand its fiat gateway infrastructure while maintaining compliance with international financial standards.

Building on recent payments and compliance initiatives

The launch follows a series of updates strengthening Binance’s payments ecosystem.

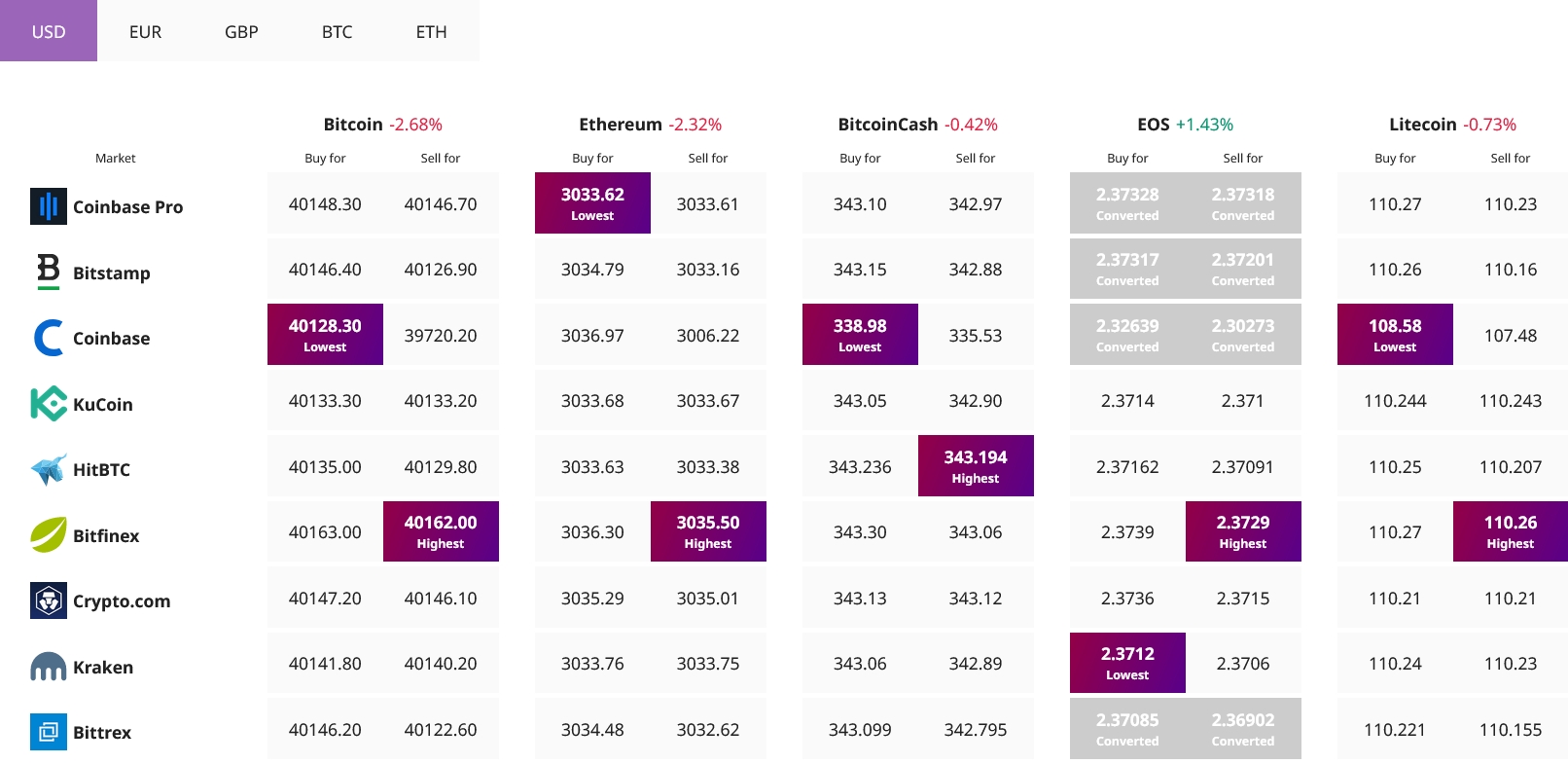

Earlier in October, Binance.US introduced dynamic withdrawal fees for ERC-20 tokens and reduced trading fees on major pairs including Ethereum, Solana, and BNB.

These changes were designed to create a more efficient environment for traders and liquidity providers across markets.

In Japan, Binance deepened its reach through a partnership with PayPay, the country’s largest cashless payment platform.

This collaboration enables users to buy cryptocurrencies directly using PayPay Money, which is then credited to their Binance accounts.

The partnership highlights Binance’s growing integration with regional payment systems to make digital assets more mainstream.

Integrating real-world assets through blockchain innovation

Beyond fiat transactions, Binance has also advanced its blockchain payment infrastructure through the integration of Plume Network.

This collaboration allows gas-free transactions for tokenised real-world assets (RWAs) across thousands of merchants, broadening the usability of digital currencies in real-world commerce.

Such developments mark a strategic evolution in Binance’s long-term objective — merging traditional and digital economies.

By combining global compliance oversight, regulated financial channels, and blockchain innovation, Binance is positioning itself at the forefront of Web3-driven financial systems.

Expanding global reach through BPay Global

The introduction of BPay Global’s USD transfer capabilities marks a critical step toward a more inclusive financial ecosystem.

By extending access to users across 70 countries, Binance not only simplifies global payments but also demonstrates its commitment to offering secure, regulated, and cost-effective cross-border financial tools.

The expansion reinforces Binance’s ongoing transition from a pure crypto exchange to a comprehensive financial services provider.

With fiat and digital assets increasingly intertwined, BPay Global serves as a bridge between legacy systems and decentralised finance, further establishing Binance’s influence in shaping the next generation of global payments.